- Infrastructure Investment Sprees: Major economies, including the United States, China, and members of the European Union, have rolled out large-scale infrastructure packages. The U.S. Infrastructure Investment and Jobs Act (IIJA), for instance, has allocated billions of dollars to road, bridge, and energy infrastructure projects, boosting the need for operational excavators. This, in turn, has increased demand for replacement parts such as hydraulic cylinders, buckets, and engine components, as construction companies seek to minimize downtime.

- Aging Equipment Fleet Replacement: Industry data shows that a large portion of excavators in use globally are over 10 years old. As these machines near the end of their operational lifespan, owners are opting to replace critical parts rather than invest in new equipment— a cost-effective choice amid economic uncertainty. For example, in Southeast Asia, a region with a high concentration of aging construction machinery, demand for excavator undercarriage parts (including tracks and rollers) has risen by over 15% year-on-year.

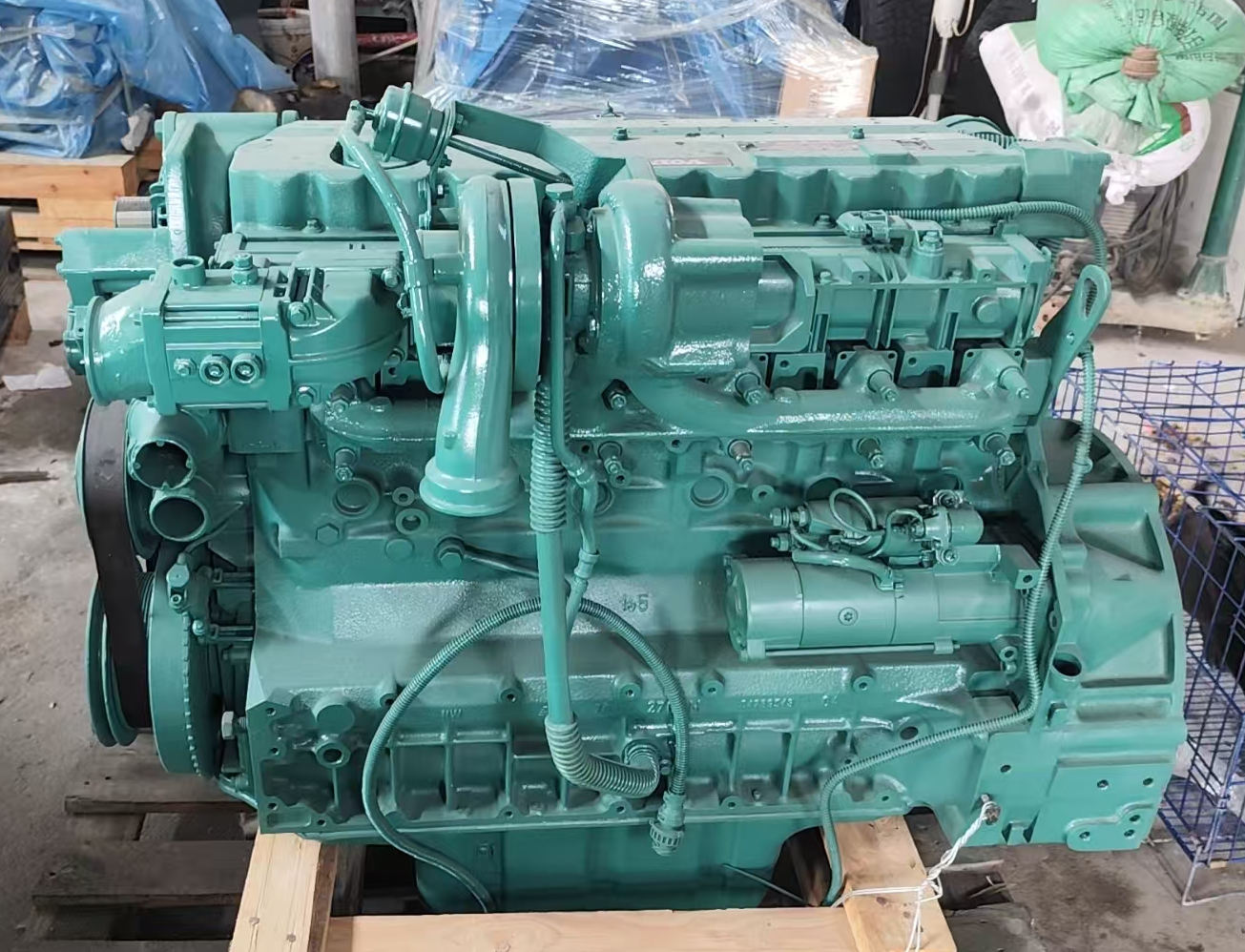

- Shift Toward Sustainable and High-Efficiency Parts: With the construction sector increasingly focusing on reducing carbon emissions, manufacturers are launching eco-friendly excavator parts. These include energy-efficient hydraulic systems, low-emission engine filters, and wear-resistant components made from recycled materials. Leading parts suppliers, such as Caterpillar Inc. and Komatsu Ltd., have reported strong sales of their “green parts” lines, as construction firms aim to meet environmental regulations and sustainability goals.

While demand is booming, the excavator parts market still faces lingering supply chain challenges, such as shortages of raw materials (e.g., steel and rubber) and logistics delays. However, industry players are adopting new strategies to mitigate these issues:

- Localized Production: Many multinational parts manufacturers are expanding production facilities in key markets, such as India and Brazil, to reduce reliance on long-distance shipping and shorten delivery times.

- Digitalization of Inventory Management: Companies are leveraging IoT (Internet of Things) and AI-powered platforms to track parts inventory in real time, predict demand spikes, and optimize stock levels. This has helped reduce lead times for critical parts by an average of 20%, according to a survey by the Association of Equipment Manufacturers (AEM).

- Aftermarket Growth for Used Parts: The rising cost of new parts has fueled growth in the used excavator parts market. Platforms specializing in certified used parts—offering warranties and quality checks—are gaining traction, particularly among small and medium-sized construction businesses.

- Smart Parts Integration: The adoption of smart, sensor-equipped parts is on the rise. These parts can monitor performance, detect wear and tear, and send real-time alerts to operators, enabling predictive maintenance and reducing unexpected breakdowns. For example, some manufacturers now offer hydraulic pumps with built-in sensors that track pressure and temperature, helping extend the part’s lifespan by up to 30%.

Industry analysts predict that the global excavator parts market will continue to grow at a compound annual growth rate (CAGR) of 6.8% between 2024 and 2029, driven by ongoing infrastructure projects and technological advancements. As the market evolves, players that prioritize sustainability, digitalization, and localized supply chains are expected to gain a competitive edge.